Log in as a...

New!

We’ve partnered with CREA to help improve your member experience and give your information the best security possible.

Click Here for additional instructions on the member login.

You will be returned to OREA once you have successfully logged in.

Tax Fairness for REALTORS®

Personal Real Estate Corporations

The ability of Ontario REALTORS® to form Personal Real Estate Corporations (PRECs) comes from the Trust in Real Estate Services Act, 2020 (“TRESA”) and came into force on October 1, 2020.

Real estate salespeople and brokers may incorporate in Ontario and arrange for their self-employed revenue to be paid into a PREC. Many real estate professionals will choose to incorporate to take advantage of certain tax benefits. There is a lot to consider before you form a PREC.

Let's get started

Let's get started

Forming a PREC is a complex task with a number of considerations that may differ depending on every REALTORS® own business situation. The advantages of forming a PREC exist only if it is set up correctly in accordance with your business, family and personal circumstances.

OREA cannot provide legal, tax, or business advice. The information provided here is intended as a general information guide. Federal and provincial tax laws and rates change frequently. All OREA Members should consult with their own legal counsel and tax advisors regarding their personal situations to determine if forming a PREC makes sense for them and to learn how to ensure that their PREC will provide the benefits they expect.

What is a Professional Corporation?

What is a Professional Corporation?

A professional corporation allows members of regulated organizations to enjoy tax advantages, similar to traditional private corporations. Professional corporations ensure accountability and liability, while safeguarding the public. Regulated by the Real Estate Council of Ontario (RECO) , REALTORS® have the privilege of forming PRECs under the Trust in Real Estate Services Act (TRESA).

The rules for professional corporations differ slightly across provinces and professions. It is important to work with your accountant and lawyer when you consider forming a PREC. More importantly, the manner in which your PREC functions, the shareholdings, the contractual relationships formed, and how your business is operated and documented, all affect the tax benefits you may hope to achieve.

Your current situation, your family situation, and other factors will affect whether and how you and your family can benefit from forming a PREC. You may need ongoing advice from your tax advisor to determine how to best maximize tax savings as your circumstances change from year-to-year.

It’s important to note that PRECs differ from traditional private corporations in at least the following key ways:

- Only REALTORS® can be voting shareholders of a PREC.

- Either the REALTOR® or the PREC or both are subject to the oversight and regulatory powers of RECO.

- The PREC can only be used if specific rules and regulations are followed.

- A PREC does not limit professional liability.

Is a PREC Right for You?

Is a PREC Right for You?

There are a number of factors to consider when deciding to form a PREC. OREA strongly encourages you to work with your financial advisor, lawyer, and accountant to determine if forming a PREC is right for your personal and business situation.

When beginning to think about whether forming a PREC is the right decision for you, consider the following questions:

- Are you earning more than what you need to meet your daily living expenses?

- Do you want to save more money for retirement?

- Could you benefit from distributing business income to your family members?

- Are you considering passing your business on to a family member who is or will be a real estate salesperson or broker registered with RECO?

- Are you considering selling your business to a real estate salesperson or broker registered with RECO?

- Are you incurring significant business expenses that are either not deductible, such as life insurance premiums, or only partially deductible, such as meal and entertainment expenses?

- Where are you in your professional journey? Are you just starting your real estate career or are you heading towards retirement?

Additional resources:

PRECs - What They Mean for Ontario REALTORS® (pdf)→FAQ - PRECs (pdf)→

How PRECs work

How PRECs work

When you form a PREC, you are creating a legal corporation that will receive the revenue from your real estate business, pay the expenses of your real estate business, and be a separate taxpayer. As a REALTOR®, you will need to be in full control of the PREC, which we will refer to as a “controlling registrant” in this guide, and which the regulations call a “controlling shareholder”.

To ensure that any transfer of your existing business to a PREC is done on a tax-deferred basis, you should speak to your tax advisor. This is particularly important if a controlling registrant has set up a sub-real estate brokerage and wants to form a PREC.

You will become the controlling registrant of the corporation, meaning that you will be the sole holder of all voting shares of the PREC and make all of the decisions for the PREC. In fact, only real estate salespeople and brokers registered with RECO may control a PREC. Under TRESA, PRECs do not need to become a registrant with RECO to receive compensation for a trade in real estate, so long as the PREC is controlled by an existing registrant. Non-voting shares of the PREC may be owned by your family members.

While you will be in control of the PREC, it will independently be earning revenue and paying tax on its net income. This means your brokerage will be paying the remuneration for your real estate services plus applicable HST directly to your PREC. It will be taxed at either the small business or general corporate tax rate, depending on the income level of the PREC and associated corporations, the amount of accumulated wealth held by the PREC and associated corporations, and the amount of investment income earned by the PREC and associated corporations in that year.

1 The lower small business corporate tax rate applies to corporations that are not carrying on a personal services business or specified investment business for income tax purposes. This should be discussed with your tax advisor.

Tax Deferral

01

One of the most significant benefits of forming a PREC is tax deferral.

In Ontario, the combined federal and Ontario corporate tax rate is 12.5 per cent on the first $500,000 of active business income. Any income above $500,000, is taxed at the general corporate rate of 26.5 per cent. By contrast, the highest personal tax rate in Ontario is 53.53 per cent on income over $220,000.

By forming a PREC you are able to leave a portion of your business income in your PREC, deferring the personal taxes on this income until you decide when the PREC pays this to you as either a salary or dividend. Having more available to invest in the PREC allows you to earn more investment income and this builds your retirement portfolio more rapidly.

Deferring a portion of your current income also allows you to “smooth” the recognition of your career earnings over your lifetime. Shifting the recognition of personal taxable income from your peak earning years to your retirement years means that when you do eventually have the income paid to you by the PREC you’ll be subject to a lower marginal tax rate. For example, if you are earning over $220,000 today and project that your retirement income will be $90,000 then the tax rate on a shifted dividend from the PREC drops from 47.74 per cent to 25.16 per cent.

2 This may be limited if the aggregate investment income earned by the PREC in a year exceeds $50,000.

See examples of tax deferrals in the section below.

Income Splitting

02

With a PREC you have a structure for potentially splitting the business income to achieve certain tax benefits by paying dividends to members of your family (18 years of age or older) actively involved in the business. Paying dividends can provide you with flexibility in how much income you want to distribute to lower the combined tax burden within your family and PREC. You can change the amount of dividends you pay and who receives them from year to year subject to meeting certain tax rules.

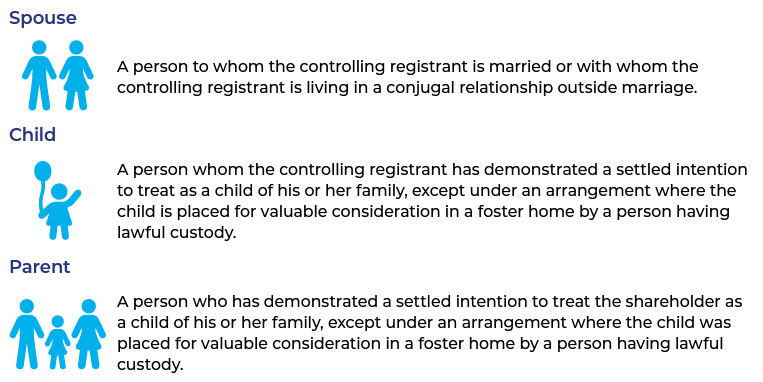

To pay dividends to your adult family members, they must become shareholders of your PREC. The regulations for PRECs under TRESA allow for the following family members to be non-voting/ non-equity shareholders of a PREC.

It is important to note that certain tax rules must be met to benefit from income splitting with family members. Generally, if the family member receiving the dividend is actively involved in the business activities of the PREC (which the Canada Revenue Agency has indicated would be met if they work an average of 20 hours or more per week and which your advisors may wish to calculate flexibility), or is significantly contributing to the business, or if the controlling registrant is 65 years of age or older, then income splitting may be achieved.

Dividends paid by a PREC to a family member outside these tax rules may be considered “split income” and subject to the highest marginal tax rate. As the controlling registrant, you will be jointly liable for the tax on this split income. The rules surrounding income splitting are complex and advice from your tax advisor is crucial before implementing any income splitting strategies.

3 While the regulation permits children under the age of 18 and even a trust for them to receive dividends, generally speaking there are effectively no tax benefits to doing so, but there may be other reasons for them to hold shares.

Flexibility of Remuneration

03

Incorporating can give REALTORS® access to different types of payment options, including salary, dividends, and bonuses. Your tax advisor may direct you to a particular mix that balances tax efficiency with other objectives in your unique circumstances.

Capital Gains Exemption

04

You may enjoy a significant tax break on the capital gains you realize on the disposition of certain private corporation shares. Each individual resident in Canada may claim a Lifetime Capital Gain Exemption (LCGE) to shelter capital gains on the disposition of qualified small business corporation (QSBC) shares.

The LCGE was increased in 2014 to $800,000 for dispositions of QSBC shares and is indexed for the years after 2014 (for 2020 it is $883,384 and you can find the current year LCGE on the Canada Revenue Agency website). Therefore, incorporating your practice may enable you to sell the shares of your PREC and shelter the growth from tax, up to the LCGE limit. Some alternate minimum tax may be payable in the year of sale, but it is typically recovered in the next 1-2 years. As suggested previously, you should consult with your tax advisor to ensure that you structure your business arrangements and the PREC appropriately to take advantage of this possibility, if it is important to you.

Deductible Expenses

05

Non-deductible and Partially Deductible Expenses

You may also enjoy a final small tax reduction in relation to certain business-related expenses you incur that are not fully deductible. This is because having such expenses incurred by the PREC means that the applicable tax rate is 12.5 per cent, whereas paying such expenses individually means that the applicable tax rate is 53.53 per cent.

For example, you may be paying $3,000 (or more) per year for life insurance. If paid individually then you need to earn $6,500 to have the $3,000 available whereas if paid by the PREC then you only need to earn $3,500 to have the $3,000 available. The death benefit remains tax-free to your family under either payment structure.

As another example, if you are currently personally incurring $6,000 per year in meal and entertainment expenses then the 50 per cent deduction limitation on these expenses means you pay $1,600 in additional tax. If these same expenses were incurred through the PREC then the additional tax is reduced to $375.

Other Types of Business

06

OREA recognizes that REALTORS® are entrepreneurial individuals, and many of them participate in alternative business activities in addition to trading in real estate. Some of these activities may be related to real estate, including property management services, ownership of investment/ rental properties, or mortgage broker activities. Others may engage in business endeavours that have little or no relation to the real estate industry.

TRESA does not limit PRECs to participating only in trading real estate. A PREC could, where appropriate and helpful, engage in other income-earning business activities, eliminating the need for a REALTOR® to incorporate a separate business to reap the corporate tax and estate planning advantages with respect to these alternative business activities.

Instead, REALTORS® can pool their funds within the PREC, avoiding any unnecessary duplication of costs and affording them the ability to participate in investment or business opportunities that require capital or make other investments.

Care should be taken to ensure that the mix of businesses and passive investments housed within a PREC does not adversely affect any other tax objectives you are working with your tax advisor to achieve.

The Costs

The Costs

Forming a corporation requires additional administrative tasks for your real estate business that can result in additional operating costs. It is important to remember that PRECs are a separate entity from you as a real estate professional, which means that you are required to file a separate income tax return for your corporation. The obligation to file payroll and HST returns will shift from you personally to the PREC, so you will need to close the personal payroll and HST accounts once you have filed any final personal returns. You will also be required to file a separate annual corporate return, in addition to the income tax return. Your advisors should provide you with the details of all these requirements.

Many professionals who form personal corporations hire an accountant to take care of their tax filings and to provide ongoing tax advice about how business income should be distributed as circumstances change from year to year. In addition, you will incur legal costs when you initially incorporate your business, prepare required PREC contracts, and on an ongoing basis to keep your corporation in good standing.

Liability and Discipline

Liability and Discipline

If you decide to operate your business through a PREC, you will remain personally liable for the services you provide to Ontario’s consumers and will be held accountable by RECO for breaches of TRESA and misconduct. A PREC is not a mechanism for avoiding professional liability. Simply put, whether or not you form a PREC, you are personally required to meet all professional obligations and responsibilities outlined in TRESA.

Real Estate Teams

Real Estate Teams

While some professional corporation regimes in Canada allow several registrants to incorporate a joint professional corporation, thereby combining their respective practices under one corporate entity, the PREC regime follows the single registrant model. Each PREC may have only one REALTOR® associated with it, who must solely control the PREC. As a result, the PREC may only receive compensation from the brokerage for trading in real estate conducted by the controlling REALTOR®, not on behalf of multiple REALTORS®.

The benefit to this model is the elimination of a separate registration requirement for the PREC. Only the individual REALTOR® needs to become a registrant and be responsible to RECO. The PREC itself will not need to seek registration and incur the additional costs and administrative burden of being separately registered.

The information on this page is available as a pdf download:

A Guide to Personal Real Estate Corporations for Ontario REALTORS® (pdf)→REACH OUT

TRESA QUESTIONS?

OREA's REALTOR® in Residence Ray Ferris has answers! Whether you need clarification around the new offer process options, or have a question about how designated representation will work at your Brokerage, OREA has your back.

Get In TouchOREA AI Assistant